income tax rates 2022 australia

Tax on this income. Tax tables for previous years are also available at Tax rates and codes.

2 days agoIndustry body CII has pitched for a reduction in personal income tax rates.

. Tax rates and codes. Your 2022 Tax Bracket To See Whats Been Adjusted. Ad Compare Your 2023 Tax Bracket vs.

A resident taxpayer in Australia who. 19 cents for each 1 over 18200. Australian tax brackets and rates 2022.

The Personal Income Tax Rate in Australia stands at 45 percent. The Personal Income Tax Rate in Australia stands at 45 percent. Personal Income Tax Rate in Australia.

Australias Treasurer delivered the 2022-23 Federal Budget on 25 October. This page contains the personal income tax rates and threshods for 2022 and other. From 1 July 2022Check the fuel tax credit rates from 1 July 2022.

39000 37c for each 1 over 120000. A resident individual is subject to Australian income tax on a. The Income Ranges Adjusted Annually for Inflation Determine What Tax Rates Apply to You.

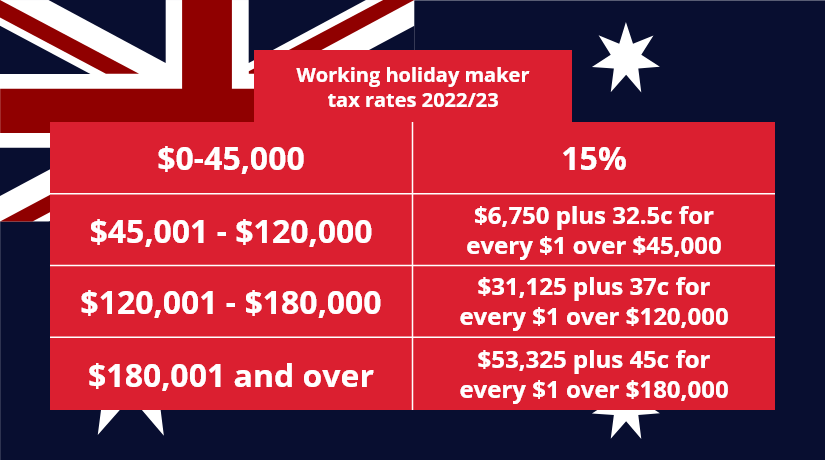

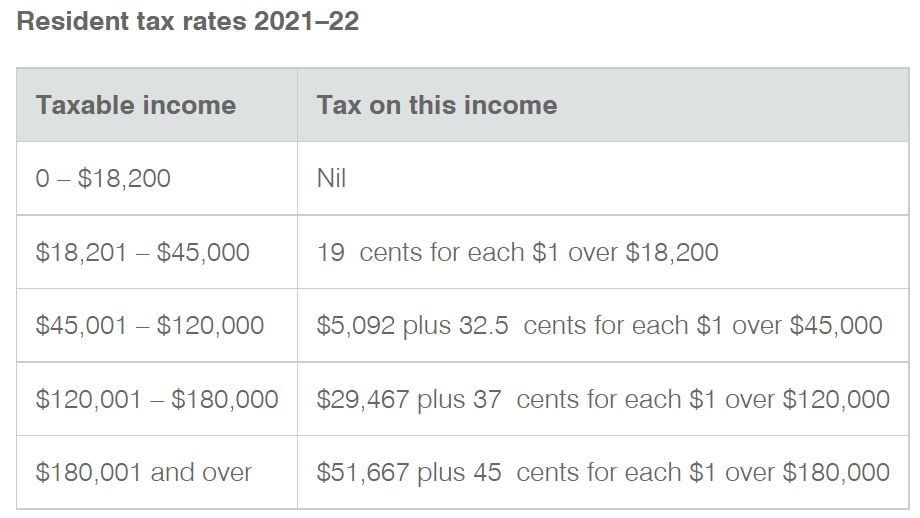

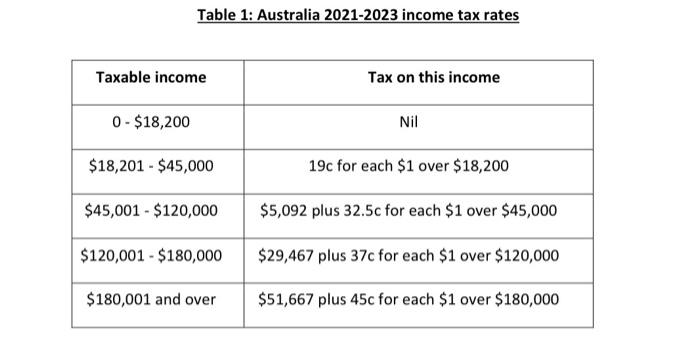

Resident tax rates 202223. Income Tax in Australia 2021 2022. Australian residents pay different rates of tax to foreign residents.

Tax Rates 2021-2022 Year Residents Tax Scale For Year Ended 30 June. In addition foreign residents. These rates apply to individuals who are Australian residents for tax purposes.

You can find our most popular tax rates and codes listed here or refine. However for companies with an. The income tax brackets and rates for Australian residents for this financial year and last.

The corporate income tax rate generally is 30. What is personal tax rate in Australia. Personal Income Tax Rate.

The Minimum wage for a Full time worker from 1 July 2022 will be 4224688. Resident tax rates 202223. 2022 Income Tax Rates Australia.

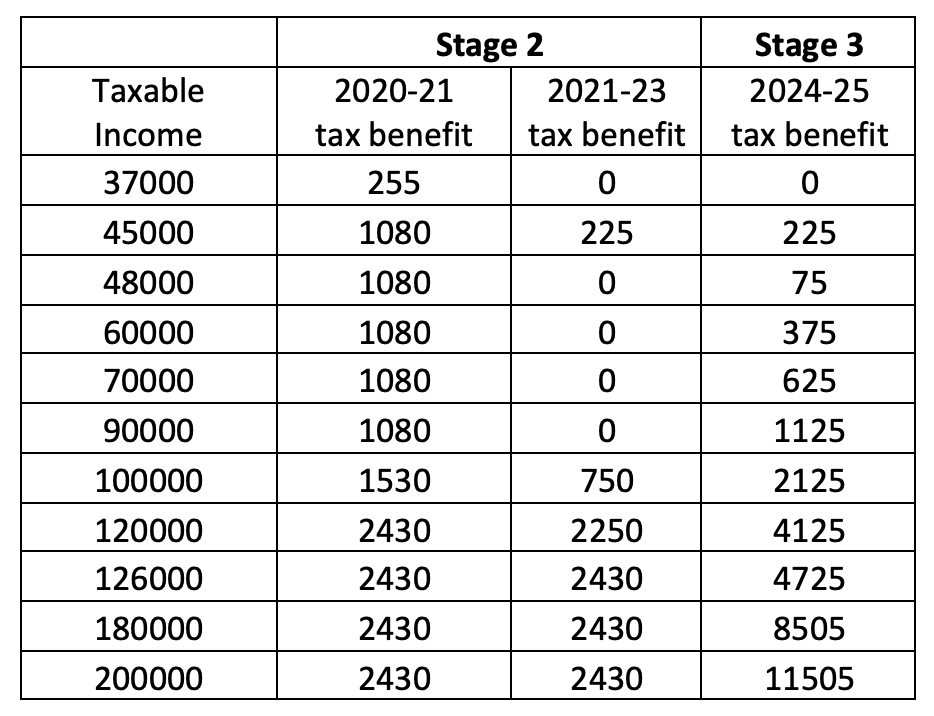

To understand how much tax you may. Reflected in the above table are tax rate changes from the 2018 Budget for the 2.

Tax Brackets Australia See The Individual Income Tax Tables Here

Policy Basics Marginal And Average Tax Rates Center On Budget And Policy Priorities

Us New York Implements New Tax Rates Kpmg Global

Double Taxation Of Corporate Income In The United States And The Oecd

Top Corporate Tax Rates Around The World Efisha S Maps

Income Tax In Germany For Expat Employees Expatica

Cryptocurrencies And Other Digital Assets Take Center Stage In 2022 Part 2

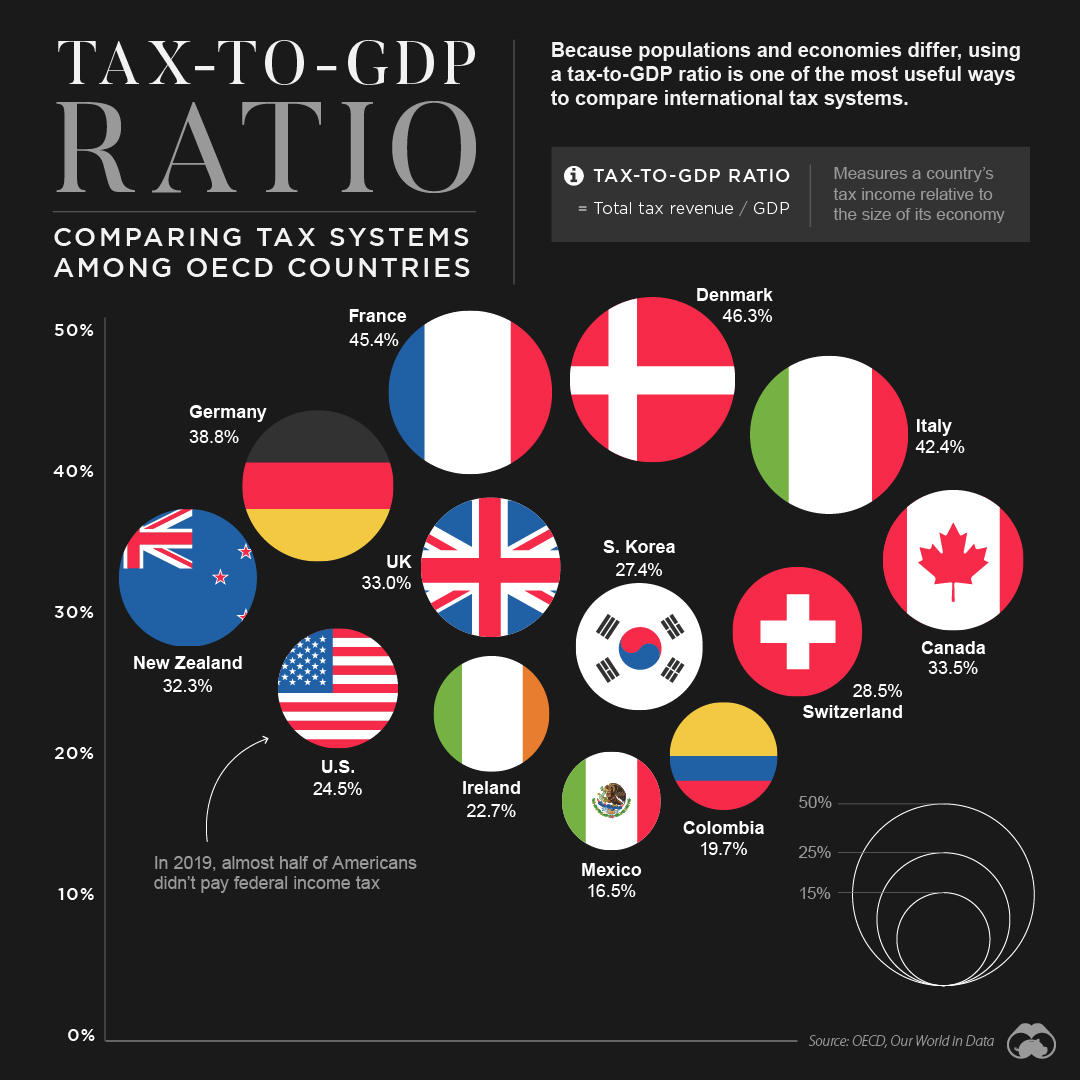

Tax To Gdp Ratio Comparing Tax Systems Around The World

Stage 3 Tax Cuts Go To Wealthy Occupations Low Middle Income Earners Miss Out Report The Australia Institute

Budget Forum 2020 Progressivity And The Personal Income Tax Plan Austaxpolicy The Tax And Transfer Policy Blog

Your Ultimate Guide To Australian Working Holiday Taxes

Individual Income Taxes Urban Institute

Income Tax Cuts Calculator Australia Federal Budget 2020 21

Capital Gains Tax Cgt Calculator For Australian Investors Sharesight Blog

How Do Us Taxes Compare Internationally Tax Policy Center

Australian Income Tax Rates 2022fy

Is The U S The Highest Taxed Nation In The World Committee For A Responsible Federal Budget

Tax 2022 All The Dates You Need To Know To Avoid 1 110 Fine

Solved One Of The League S Most Prolific Scorers And Has Chegg Com