how are property taxes calculated in martin county florida

Karthik saved 38595 on his property taxes. 097 of home value.

Martin County Property Appraiser Property Tax Estimator

I had a fantastic experience getting my property tax deal processed through TaxProper.

. Tangible Personal Property Tax is an ad valorem tax assessed against furniture fixtures and equipment located in businesses and rental property. The median property tax on a 18240000 house is 176928 in Florida. The tax year runs from January 1st to December 31st.

Reasonable real estate worth growth will not boost your annual payment enough to justify a. The median property tax also known as real estate tax in Martin County is 231500 per year based on a median home value of 25490000 and a median effective property tax rate of. Tax amount varies by county.

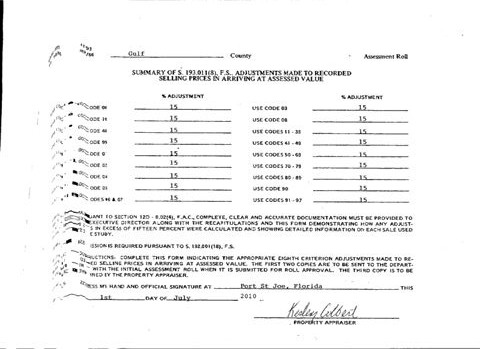

The process was simple and uncomplicated. The office of the Property Appraiser establishes the value of the property and the Board of County Commissioners School Board. Thoroughly calculate your actual tax using any tax exemptions that you are allowed to utilize.

Having trouble finding what youre looking for in our website. Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Apply for Business Tax account Edit Business Tax account Run a Business Tax. The taxes due on a property are calculated by multiplying the adjusted taxable value of the property by the millage rate.

The county median home value of 255000 which means that the typical homeowner. A number of different authorities including counties municipalities school boards and special districts can. The median property tax in Florida is 177300 per year for a home worth the median value of 18240000.

Were here to help you. To report an ADA accessibility issue request accessibility assistance. Martin County is committed to ensuring website accessibility for people with disabilities.

It also applies to structural additions to. For example the property taxes on a home with a homestead. Please note that we can.

To calculate the exact amount of property tax you will owe requires your propertys assessed value and the property tax rates based on your propertys address. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in Martin County.

Property Tax By County Property Tax Calculator Rethority

Florida Vehicle Sales Tax Fees Calculator

4920 Se Pine Ridge Way Stuart Fl 34997 Realtor Com

Property Owners Want Lower Tax Rates In St Lucie County

2568 Nw Eventide Pl Stuart Fl 34994 Realtor Com

Real Estate In Martin County Florida

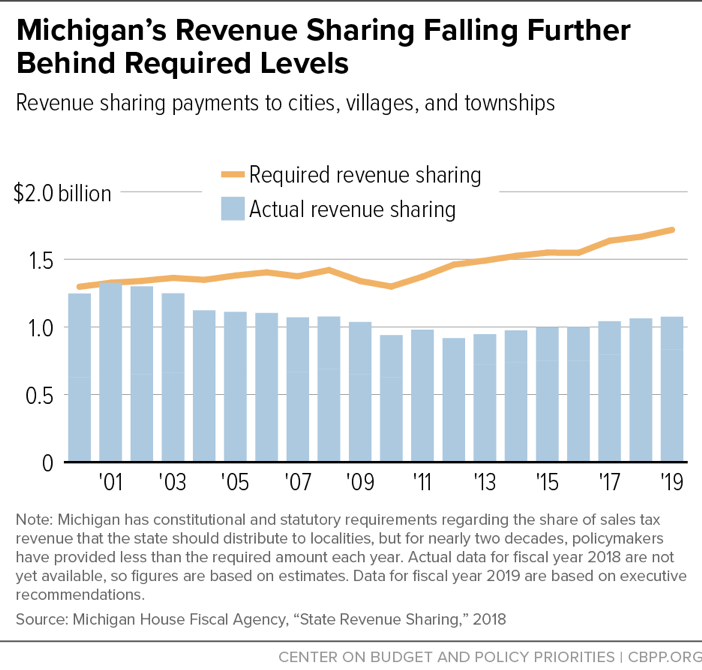

State Limits On Property Taxes Hamstring Local Services And Should Be Relaxed Or Repealed Center On Budget And Policy Priorities

Florida Dept Of Revenue Property Tax Data Portal

States With The Highest Lowest Tax Rates

7705 Sw Martin Hwy Palm City Fl 34990 Realtor Com

Martin County Property Appraiser Property Tax Estimator

Martin County Fl Real Estate Martin County Fl Homes For Sale Zillow

Property Taxes Hendry County Tax Collector

Florida Property Tax Calculator Smartasset

467 Sw Lost River Rd Stuart Fl 34997 Realtor Com

State Limits On Property Taxes Hamstring Local Services And Should Be Relaxed Or Repealed Center On Budget And Policy Priorities